System1 Snack Wars: Miami vs Brazil

The level of diversification in the snack category is remarkable. Across borders, oceans, and continents, the variety and volume of products on offer is staggering. It’s not just about differences in packaging or language. Flavors, textures, ingredient sourcing, food safety standards, and even how snacks are displayed in supermarkets can vary dramatically. The list goes on. While there are some familiar parallels, like a Tim Tam in Australia and a Penguin biscuit in the UK, many snacks feel completely foreign from one market to the next. And if you’ve ever watched Snack Wars, you’ll know just how polarizing snacks can be, even from state to state.

So how do brands bridge these cultural gaps and successfully launch unfamiliar products into new territories?

Having lived and worked in Brazil for many years and now based in Miami, this snack divide is something I know well and was eager to put to the test. Ahead of a company kickoff in Brazil, I made a quick stop at my local supermarket to stock up on some classic US treats for our LATAM team to try. I was confident a few would be crowd-pleasers, but I had my doubts about others. The real question was whether my instincts would prove right.

Putting Theory into Practice

At System1, if there’s one thing I’ve learned, it’s this: we, whether researchers, marketers, innovators, or R&D teams, are not the consumer. More often than not, our own opinions and theories betray us, and the least likely candidates end up winning. It’s a truth worth keeping front of mind.

When I shared a selection of US crowd-pleasers with our LATAM teams in Brazil, each group was asked to taste the snacks, review the packaging, weight, and ingredients, and then decide collectively which product they thought would be the biggest success and which one would likely fall flat. My stomach is rumbling just thinking about it.

It was a lot of fun, but more importantly, it was deeply insightful. In parallel with our internal experiment, we also tested each product with a nationally representative Brazilian audience using System1’s Test Your Innovation platform to compare results.

Test Your Innovation follows a similar methodology to our team experiment, although with a much larger sample size. However, it introduces one key difference: the focus on emotion. The platform emphasizes how people feel rather than what they think, which is proven to be far more predictive of in-market success.

We looked at three core measures to assess each US snack with Brazilian consumers:

- Emotional Pull: Using our FaceTrace® tool, we measured emotional resonance to see how strongly each snack connected with Brazilian audiences.

- Share Trading: We gauged consumer willingness to “buy” or “sell” the product, uncovering key insights into purchasing behavior and preference.

- Decision Speed: We tracked how quickly and instinctively consumers responded. Faster reactions were rewarded, while slower responses were penalized, giving us a clearer picture of spontaneous enthusiasm.

So, which snacks did Brazilians back? Let’s find out.

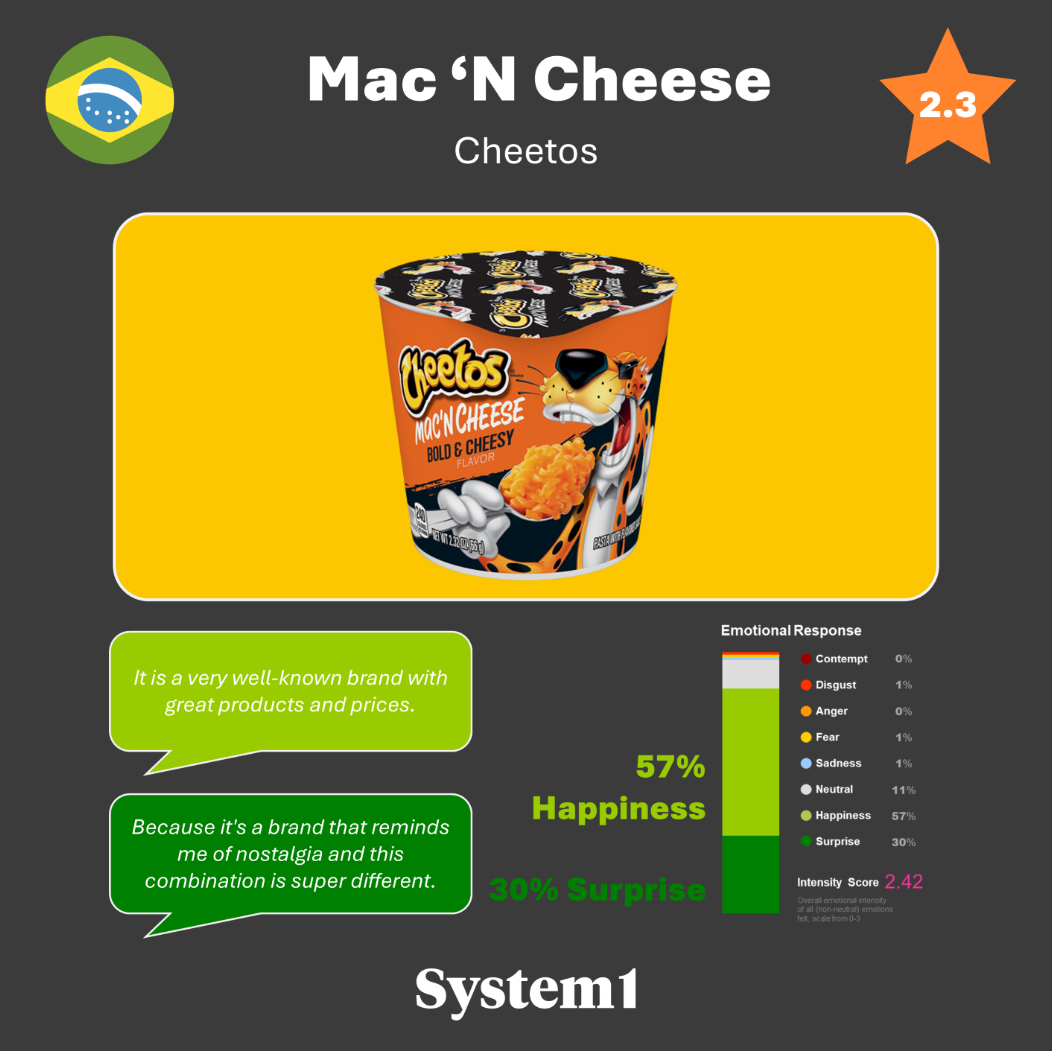

Mac & Cheese Flaming Hot Cheetos

The standout product among Brazilian consumers was Cheetos Flamin’ Hot Mac & Cheese, earning the highest Star Rating in the lineup and showing the strongest in-market sales potential. Many respondents reacted positively to the bold salty and spicy flavor profile, recognized the brand instantly, and expressed a strong love for cheese. While a few questioned the combination of Cheetos and chili, commented on the intense colors, or shared some hesitation about mac and cheese, overall feedback was largely positive.

A Shocking Dislike: Cilantro Lime Rice

Remember what I said about consumer opinion reigning supreme? Well, this one really surprised me. A family favorite in my household, mine and my wife’s, cilantro lime rice received harsh criticism from Brazilian consumers, scoring just 1 Star. The main issue was cilantro.

Interestingly, when our internal teams tasted it, the response was completely different. They loved it. This highlights just how much flavor combinations and packaging can influence perception before a product even reaches the checkout. It’s a strong reminder to test early and get it right at the concept stage so you stand a better chance of winning hearts and baskets.

Surprise Product: Corn Mayonnaise for Hot Dogs

The most surprising product of all was corn mayonnaise. In Latin America, this is praised and popular, but Brazilians couldn’t quite get on board. Again, it came down to flavor and cultural taste preferences. These two ingredients are unfamiliar when combined and therefore unappealing to local audiences. The brand and packaging were less of a concern, described as high quality and well-known, but the corn mayo collaboration? No thanks!

Final Thoughts to Chew On

Now, let’s remember that in their respective markets, these products are well-liked and popular. Our experiment simply explored how a different market might respond to their introduction. These products don’t actually exist in Brazil yet. That said, if they were to launch, we uncovered some interesting insights:

80% familiar and 20% new

The most popular product was also the most familiar. Cheese, chili, salt, and Cheetos are flavors and a brand already recognized by Brazilian consumers. This reflects a common pattern in successful product launches, where familiarity tends to outweigh novelty.

In his book System1: Unlocking Profitable Growth, John Kearon identifies the golden ratio for innovation as 80 to 20, meaning 80% familiar and 20% new. The most successful products create more happiness than surprise, and that balance tends to favor what people already know. Success isn’t driven by shock value. In fact, it is often quite the opposite. Familiarity breeds contentment.

Create Curiosity

Legacy brands with strong loyalty can be powerful vehicles for introducing new products. Consumers are more likely to try something unfamiliar when it’s backed by a brand they already trust; take Cheetos as an example. The same applies to brand ambassadors. You might not have heard of a product before, but if your favorite athlete, celebrity, or musician is seen using it, that endorsement alone can be enough to spark interest. And as we saw with the cilantro lime rice, sometimes all it takes is one try to turn curiosity into long-term loyalty.

Sometimes Books Are Judged by Their Covers

Packaging design, color choices, and overall presentation can have a significant impact on how a product is perceived in different markets. When testing early, before making major investments, it’s important to explore variations in wording, visuals, and pack formats. Even small tweaks can lead to stronger consumer responses and a greater chance of in-market success.

Start by researching what’s already on shelves. Use platforms like Test Your Innovation to understand what’s resonating and where there’s an opportunity to stand out. Then experiment with your own packaging variations to find the version that best connects with your target audience.

Create with Confidence®

There’s so much to learn when testing products across different markets. The Brazilian market is not only huge, but very unique. Consumers in Brazil have specific tastes and respond to different messaging. For anyone working in global product development or international consumer insights, I recommend you review the full Test Your Innovation Report that we’ve made available for free. This study covers all the products we tested in this fun exercise, complete with consumer commentary on each. Hopefully, it helps you see how our consumer testing solution works while giving you a chuckle or two along the way.